South Korea is big! US withdraws sales from Samsung and SK Hynix Chinese manufacturers to buy US commercial equipment license

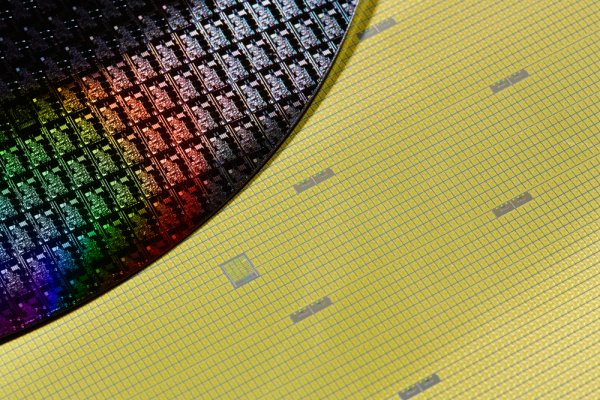

Reuters reported that the US Department of Commerce recently announced the withdrawal of partial permission, making it difficult for Korean manufacturers operating in China, such as Samsung and SK Hynix, to produce advanced memory locally because they cannot obtain more advanced equipment. This action will also affect the global semiconductor supply chain.

The U.S. Department of Commerce has withdrawn the previous permissions obtained by the Korean companies that allow them to purchase semiconductor equipment produced by U.S. manufacturers at Chinese production sites without complying with strict restrictions set for 2022. This means that Samsung and SK Hynix must now apply for a license and wait for their passing before purchasing related equipment for their China location. Among them, although Intel, the largest processor manufacturer, completed the transaction to sell a large factory in China in 2025, the company also ranked on the list of lost licenses.

These withdrawal orders will take effect in 120 days. In response, the U.S. Department of Commerce said in a statement that although it plans to approve the license for the existing facilities of these companies to operate in China, it does not intend to approve the license for capacity expansion or upgrade technology. This policy change will create a major challenge for Korean memory manufacturers' long-term development in China, as the status of existing facility verification final user (VEU) will be removed, which prevents U.S. equipment suppliers from shipping related products to China.

SK Hynix stated that it will maintain close communication with the Korean and US governments and take necessary measures to minimize its impact on business. As for, Samsung has not commented on this yet. The Korean Ministry of Industry said that the Korean government has explained to the US Department of Commerce that the importance of Korean memory companies' continued operation in China and the stability of global semiconductor supply chains will also continue to discuss with the US in order to minimize the impact on Korean companies.

In addition, this change in permitting policy is expected to reduce the sales status of US equipment manufacturers including KLA Corp, Lam Research and Applied Materials in the Chinese market. Therefore, after the news was released, Colin R&D shares fell 4.4%, Applied Materials fell 2.9%, and Colei shares also fell 2.8%.

This US action may have an unexpected impact on some market manufacturers. Market insiders pointed out that this may make it more difficult for Korean memory manufacturers operating in China to continue producing advanced chips. Additionally, this measure may help local equipment manufacturers in China as their tools can fill future market gaps. In addition, American manufacturer Micron, which competes with Samsung and SK Hynix in the memory market, may also benefit from it. However, if there is no further action on memory manufacturers such as China's Changjiang Cash (YMTC) and Changxin Cash (CXMT), this may open up market space for Chinese companies by sacrificing Korean companies as the price.

The United States and China are still in a tax break situation. The United States will be charged a 30% tax on Chinese imports of US products, while China will be charged a 10% tax on US goods, which will last until November. Currently, thousands of US companies are applying for licenses for exporting goods and technology to China, but they have been in a state of uncertainty recently, resulting in order pressures including semiconductor manufacturing equipment worth $1 billion. The U.S. gains this time, the permission of Korean chip manufacturers in China is its latest strategy to implement more broad restrictions on China in the semiconductor field.