Economic Department: 232 The US-related tax products account for 80% of the total, covering semiconductor servers

The 90-day deadline for taxes in the United States will reach. The Ministry of Economic Affairs stated that compared with the proportion of tax products in the United States, the proportion of exports to the United States by the United States by the United States is about 20%, and the proportion of products in the United States with 232 surveys covers nearly 80% of the US products, including ICT products such as semiconductors and servers, which has a greater impact on Taiwan factories. However, after observing the U.S.-U.K. trade agreement, "232 taxes are not a piece of iron plate", the government closely monitors the U.S.'s subsequent actions.

Qiu Qiu Hui, director of the Ministry of Economic Development Agency, attended a forum event speech on the 18th and said that the three major tax measures in the United States include fentanyl tax, 232 tax and relative taxes, and 232 tax and relative taxes do not repetitive taxes. However, the 90-day limit for taxes on all other taxes will be reached, and many countries and the United States are still in the debate stage and must pay close attention to the continued actions of the United States.

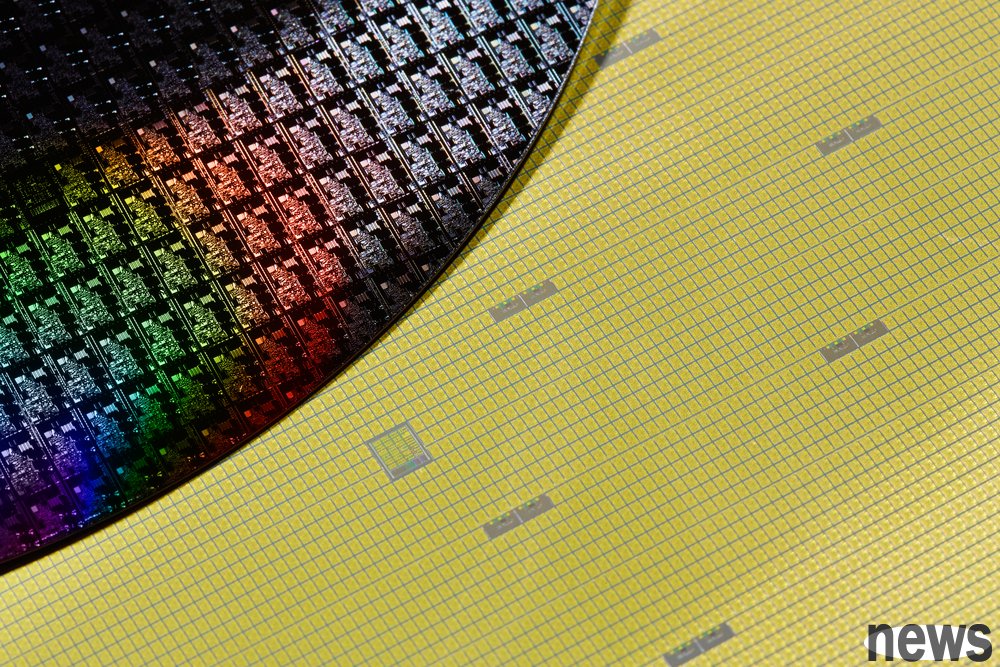

The United States conducts a national safety survey on semiconductors, drugs, key minerals, coppers, aquaculture and energy under the "Terms 232". Qiu Qiuhui said that what Taiwan needs to pay the most attention to is the results of the US's 232 survey on semiconductor-related products, because currently, nearly 80% of Taiwan's exports to the US have a 232 tax rating, and the impact on tax ratings accounts for only about 20%.

Based on the figures of Taiwan's exports to the United States, in 2024, Taiwan's exports to the United States reached US$111.4 billion, accounting for 23% of the total exports, electronic information exports accounted for 71%, and other traditional industries accounted for about 29%; the proportion of tax-related products to the United States was 20%, and the proportion of 232 products accounted for 78%.

Qiu Qiuhui said that during the 232 investigation period in the United States, 20 ICT products such as semiconductors and display cards and servers were exempted from taxes, and products such as PCBs and Internet parts were subject to 10% tax. Taiwan's industry is reliable. As long as the US tax rate is similar to that of other countries, it is still competitive. However, the traditional industry has suffered a greater impact. Therefore, the government has also proposed an industry support plan to help employees with tax interference.

The UK reached an agreement with the United States on May 8, and the United States imposed a 10% tax on imported products in the UK, and the UK's average tax on imported products in the US dropped to 1.8%. Qiu Qiuhui said that after observing the US-UK trade agreement, "232 tax is not a piece of iron plate." The US-UK trade negotiations are not limited to taxes only, and also cover 232 taxes, including 10% of the applicable tax for 100,000 cars imported to the United States each year, and 25% of the tax required for classes exceeding the allocation.

Taiwan and the United States completed the first round of physical consultations on May 1. Qiu Qiuhui said that the Taiwan-US negotiations have been smooth, and the government will try its best to win the best interests of the industry and the people. The relevant negotiation details will be announced in accordance with the Executive Yuan Trade and Judgment Office (OTN).

As for the issue of reducing taxes on automobiles that are concerned by the outside world, Qiu Qiuhui pointed out that after observing the results of the US-UK dispute, the US-UK trade agreement was atypical free trade agreement (FTA), and it has not been approved by the US-UK, nor will it retrospectively retrospectively the principle of the most favorable national treatment of the International Trade Organization (WTO). Therefore, if the tax on imported cars in the United States is only reduced, the tax on imported cars in Japan and South Korea will remain unchanged, and the impact on Taiwan factories will not be so big.

Officials have additional explanations that there are many types of agreements on both sides, and the FTA must meet specific conditions. However, the United Kingdom-US trade agreement is an atypical FTA, and the agreement is reached by two parties at a high level, which is also binding. Therefore, even if it is not an FTA, it will not retrospectively revisit the WTO's most favorable country treatment. In addition, various countries are currently focusing on discussing taxes with the United States, and have no energy to deal with tax issues with other countries.