I was so sad about Taiwan s electronic industry that year, but now I am on the cliff: Samsung s "Taiwan Plan" has been backfired?

Samsung seems to be in a state of suspension recently. Not only does the crystal OEM business fail to catch up with the dominant position of power supply and DRAM, the yield of South Korean rival SK Hynix and advanced process has faced a big setback. The latest news also calls the Texas factory postponed the launch. Faced with these difficulties, Samsung has resolutely adjusted its company strategy. Who remembers that Samsung issued a luxury to defeat Taiwan more than ten years ago, and even launched the "Kill Taiwan Plan".

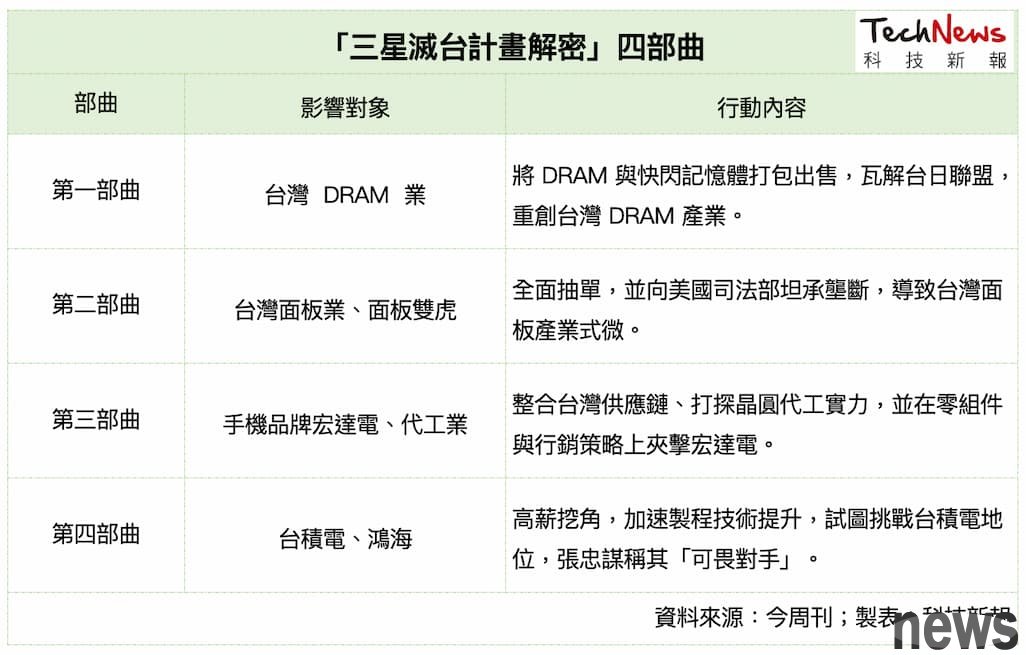

Samsung starts the Taiwan plan, and the final goal is to snipe Taiwan power and duck seaFrom 2012, Samsung suffered from Taiwan's DRAM, panel and LED industries through the "Taiwan Plan". At that time, the most well-known brand Hongda Electric (HTC) was affected, and the next step was to kill Taiwan's technology dragon-head Taiwan Electric and Duck Sea.

"This Weekly" has done the topic of "Samsung Taiwan Plan Decryption". The plan is divided into four parts, and it is finally packaged with DRAM, flash memory, etc. for sale, disintegrating the Taiwan-Japan DRAM alliance and crushing Taiwan DRAM Industry; then, it is a comprehensive order, a confession to the US Department of Justice that the joint failure was shattered, and the Taiwan panel industry was "uprooted"; the third part is to integrate Taiwan's supply chain, explore the strength of Taiwan's crystalline foundry industry, and focus on the zero components and marketing strategy, and finally defeat the "Light of Taiwan" Hongda Electric.

In the last part, Samsung decided to kill Taiwan-protected Shenshan Taiwan Power and global OEM Longtou Hai. For example, high-paying poaching, the process yield quickly caught up with Taiwan Power. Samsung's arrival also made Taiwan Power Chairman Zhang Zhong, a chairman of Taiwan Power, jointly emphasized Samsung as a "terrifying opponent" in various venues.

After the fierce competition, Samsung grew rapidly and flourished, but seemed to have forgotten that history will repeat itself. When it looks down at the supply chain in a compressive posture, China's Red Marine Force and South Korea's competition are quietly awaiting development and waiting for action.

The wind and water wheels flowed, and Samsung was almost flooded by the Red Sea in China.However, after more than ten years, the technology industry has changed rapidly. Samsung has suffered setbacks and lost its energy in recent years. It is now working hard to return to its former dominant treasure.

First in the DRAM field, Samsung disbanded the HBM group at that time due to a mistake in 2019 due to an error in determining that the market would not grow significantly, so it continued to fall behind its peer SK Hynix, and gradually expanded the gap with the help of the AI wave.

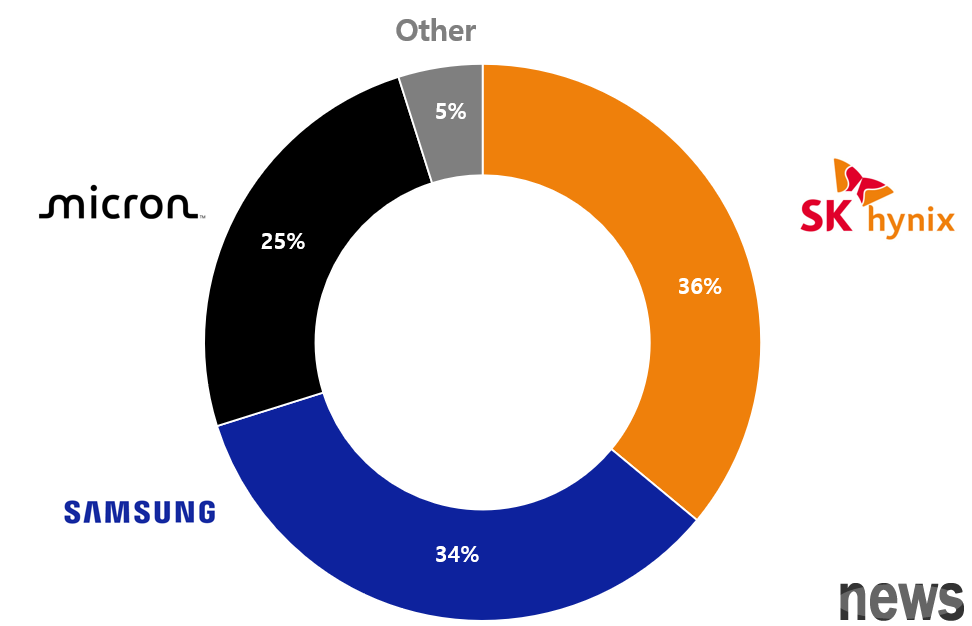

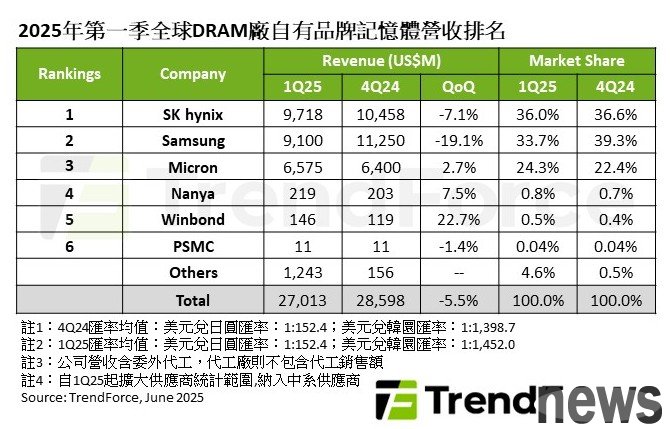

Research and development agency TrendForce data showed that the once-year-old SK Hynix finally surpassed Samsung Electronics for the first time, accounting for 36% of the market to lead global DRAM acquisitions; Samsung's ranking fell to second place due to the inability to sell HBM directly to the Chinese market and the HBM3e revision significantly reduced the shipment of high-priced products, etc.

Currently, Samsung plans to launch an enhanced version of 12-layer HBM3E chips in the second quarter of this year, accept NVIDIA's final assessment, and plan to produce advanced HBM4 chips in the second half of the year, and also supply samples to major customers such as NVIDIA and AMD to return to the former kingly treasures.

For panels, LEDs and traditional DRAM, Samsung has also faced the low-price killing of China's supply chain, choosing to exit the market or change to a higher technical route. But what is terrible is that China's Red Sea offensive is still coming in waves. In addition to snatching the market at low prices, many Chinese practitioners have also used favorable conditions to poach Korean semiconductor talents and shorten the technical pursuit process.

Under this attack, Samsung announced in 2022 that it would close the LCD panel production line and convert OLED and quantum point panel technology; in 2024, it announced its withdrawal from the LED business and focuses on power semiconductors and Micro LED technology; as for the traditional DRAM part, with the full capacity of Chinese DRAM factories such as Changxin Cash, the price has been killed in Honghai. Samsung will discontinue the production of DDR4 memory modules at the end of this year, focusing on DDR5 and LPDDR5 Memory and other technologies that are more profitable.

In terms of mobile phone brands, in terms of shipment and market share, Samsung still maintains the brand's dragon-headed throne, but the global smartphone sales list in the first quarter of this year was reversed by Apple, dominated by iPhone 16, and included the top four. The fifth place was Samsung Galaxy A16 5G.

Sniper tyres failed! Samsung temporarily exits advanced process competition

Sniper tyres failed! Samsung temporarily exits advanced process competition

It is worth noting that Samsung launched the "Taiwan Plan" that year and recreated the Taiwanese electronics industry. It once bit the Taiwan electric power, and even threatened it to the back of the brain. Fortunately, the Taiwan electric power did not rush on its own, and followed its own rhythm and finally cleverly rushed over and chased.

Now, Samsung's 3-nanometer yield yield is only about 50%, and 2-nanometer yield is also behind the power supply. 4-nanometer originally cooperated closely with AMD in the SF4X process, but now the order for the order has been re-entered and commissioned by Taiwan Electric to manufacture the EPYC server central processor. The 5/7-nanometer process with good results has also been exported to SMIC to defeat Chinese enterprise orders.

In addition, Google's upcoming flagship mobile phone Pixel 10 series has released the Tensor G5 chip that has been repurposed for the first time with the second generation of NT$3N3E. The sudden change caused a major blow to Samsung.

As the market share gap with Taiwan Power has widened, the international gap with SMIC has narrowed and the global market has continued to fall, Samsung has significantly adjusted its crystalline foundry strategy, such as the 1.4 nanometer process was delayed from 2027 to 2029, two years later than the original target, and at the same time, it has retreated from the pace of advanced processes and stabilized the existing process yields..

Industry insiders revealed that Samsung has recently clearly stated that it will no longer blindly pursue advanced processes such as 1.4 nanometers, but will improve the stability of existing processes, such as strengthening the yield of 2 nanometers, providing more customized services, and introducing a one-stop (turnkey) solution that combines its own memory.

Although Samsung adopts a pricing strategy of 30% cheaper than TEU, the performance of 4/5/7 nanometers must also be improved to maintain customers' competition. 2 nanometers, Samsung plans to strengthen the second generation (SF2P) process, and next year's mass production third generation (SF2P+) process, and the overall efficiency is expected to increase by about 20%.

Industry insiders admitted that "Samsung needs to have a more differentiated strategy in order to compete with Taiwan Electric. Samsung is improving 4 nanometers and 5 nanometers, because these areas are not yet mastered by manufacturers such as SMIC. Samsung has some advantages, which will help reduce its obstruction in the short term."

At the same time, Samsung's crystal circle OEM business also faces severe challenges, with the 2024 business stake in 4 trillion Korean circles, twice the number of the previous year. Analysts predict that the annual peril may still reach about 3 trillion Korean circles.

Although Samsung Texas Factory's previous construction progress has reached 99.6%, which is exactly completed, due to weak market demand and insufficient customer volume, the company has decided to postpone the start-up process of the factory. As for when it can be officially launched and invested, it still depends on the subsequent market changes.

Will Samsung welcome the final song or stage the next song?From Samsung's strength to its later difficulties, they have repeatedly proved what Samsung Electronics former president Lee Kun-hee said.

According to the "Daily", in order to tell the company that it is full of self-confidence, Lee Kun-hee said: "In the past ten years, the current representative businesses and products may disappear. Even first-class multinational companies will collapse. We don't know what Samsung's future will be. There is no time to hesitate, so we must come back."

That year, Samsung's "Taiwan Plan" once made the entire Taiwan electronic industry feel stressful, but the wind and water flow are now in a dilemma of its own crystal circle OEM and delaying and difficult production. The plan to defeat opponents in that year is now a test that has become its own experience under the rapid changes in local politics and the reshaping of supply chains.

Industry competition has never been faster than who can run faster, but who can walk smoothly. I believe that Samsung has now realized that it is difficult to rely on slams and scale. Only by revising the essence of technology, deepening customer relations, and properly responding to ground risks can we have the opportunity to stand firm in the new global semiconductor system.

The next round of competition has quietly begun. Whether Samsung can regain its dominance will still need time to verify.

Extended reading: No more 1.4 nano-track supercar! Samsung has changed to conservative routes, focusing on improving 2/4 nanometer yields It is difficult to catch up with Taiwan's electricity below 3 nanometers, Samsung changed to 5/7 nanometers to make a difference In addition to no customer orders, Samsung Taylor crystal factory delayed the market due to process technology