4Q25 DRAM prices continue to rise, server demand fermentation in advance, and old process products still increase in

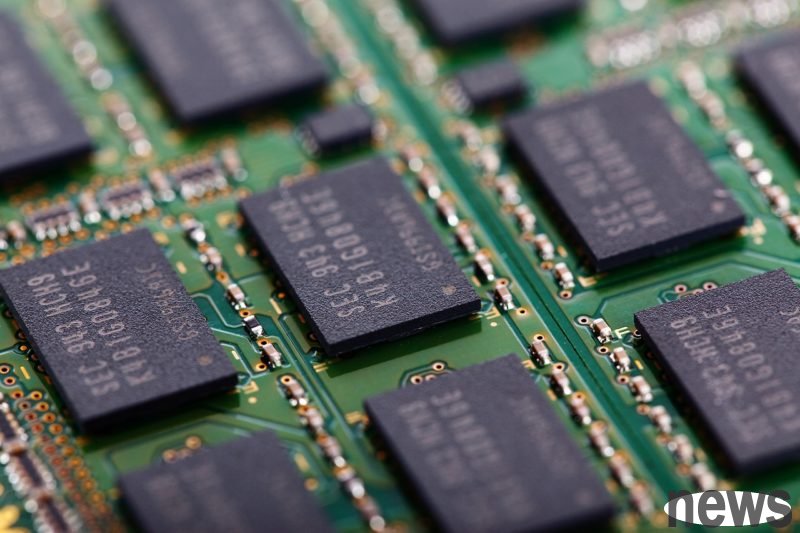

TrendForce's latest survey shows that the three major DRAM original manufacturers have continued to be the first to allocate advanced process capabilities to high-level server DRAM and HBM, eliminating PC, mobile devices and consumer application capabilities. At the same time, affected by the differentiation of demands of various end products, the price of old process DRAM in the fourth quarter is still visible, and the new generation of products is relatively gentle. It is estimated that the overall general DRAM price will increase by 8% to 13% in the quarter. If HBM is added, the increase will increase to 13% to 18%.

The price of PC DRAM is slightly higher, and American CSP intends to purchase server DRAM in advanceIn the fourth quarter, PC promotion and storage energy are slim, PC OEM whole machine shipment estimates have decreased, and the DRAM bit purchase volume of major OEMs will be reduced in season. In addition, the three major original manufacturers' active transfer capacity to server DDR5, and the supply scales of PC DDR5 and PC DDR4 are all limited, and the overall PC DRAM price continued to rise slightly in the fourth quarter.

The demand for server DRAM continues to increase due to the CSP (cloud service provider) construction and power recovery, and the demand for DDR5 products continues to increase. Whether it is the US or Chinese CSP, the demand for DRAM purchases in 2026 is expected to grow significantly. In order to ensure that they receive sufficient supply, American businessmen even plan to start purchasing in the fourth quarter in advance, so they are more open to the price. Despite the original manufacturer's efficient allocation capacity, some suppliers' technical problems, as well as the original manufacturers' plan to give HBM4 in the first half of 2026, all of which invested variables for DDR5 supply, and the price forecast for the fourth quarter remained rising. In addition, although some original manufacturers delayed the DDR4 schedule for specific customer servers, the price of DDR4 in the fourth quarter is still quite high due to the continued purchase heat.

Mobile DRAM prices rose, and the demand for picture DRAM will not decrease, and the consumption-level DRAM has increased compared to last quarter.The mobile DRAM-LPDDR4X for medium and low-level smartphones continue to be reduced due to the continuous reduction of global total supply bits. The brand has strengthened supply and demand imbalance, resulting in increased supply and demand imbalance, and has led to a quarterly increase of more than 10% in the fourth quarter. As for LPDDR5X, in addition to high-level smart phones, other end applications have also expanded; although there is no obvious shortage in the short term, considering factors such as continuous supply capacity and product pricing strategies, TrendForce estimates that the price of LPDDR5X will remain on the rise in the fourth quarter.

The trend of PC application preparation in the fourth quarter, and the market's expectations for the NVIDIA RTX6000 series have increased. The GDDR7 price has been continuously drawn to increase its sales. In addition, the original factory predicts that supply will be in short supply, and the increase in GDDR7 prices will increase compared with the previous quarter. The old-generation GDDR6 has a certain adoption ratio of the previous generation of cards, and the purchase volume is still quite low, but due to obvious restrictions on supply, the price in the fourth quarter continued to rise higher than that of GDDR7.

The original factory's supply of consumer DDR4 is also very limited and the price is certain. Since the end product sales have not increased, and the DDR4 price has nearly doubled in the third quarter, the buyer's tracking power has been reduced, and the price will close in the fourth quarter. DDR3 continues to prepare goods in advance, and with the ability to be discharged and the original factory quickly displaced inventory, the price will continue to rise in the fourth quarter.